India’s electric vehicle (EV) ecosystem is charging ahead, with two-wheeler sales projected to surge to 25-30 lakh units in 2025, up from 17.3 lakh in 2023-24, boasting a staggering 49% CAGR through 2030. Yet, beneath this optimistic veneer lies a glaring bottleneck: the dearth of reliable, feature-packed electric motorcycles priced under ₹1 lakh. As the backbone of India’s mobility—accounting for over 80% of vehicle sales—the two-wheeler segment remains tantalizingly out of reach for the masses, whose average income hovers around ₹2-3 lakh annually. This affordability gap is not just slowing EV penetration but threatening the government’s ambitious 30% electrification target by 2030.

While a handful of electric bikes flirt with the sub-₹1 lakh mark, they often fall short on the “good” metrics that discerning buyers demand: robust build quality, a respectable 100+ km range, fast charging, and modern features like app connectivity or ABS. Leading the pack is the Revolt RV1 at ₹89,990, offering a 100-160 km range but plagued by reports of inconsistent battery life and limited service networks in Tier-2 cities. The Ola Roadster X follows at ₹94,999 with a similar 100 km range, yet users frequently cite software glitches and overheating issues during peak summer rides.

Other contenders include the Oben Rorr EZ (₹99,999, 110-175 km range) and Vida VX2 (₹48,186-₹86,599), which promise affordability but compromise on power (under 5 kW) and top speeds (below 60 km/h), rendering them unsuitable for highway commutes or even spirited urban dashes. In contrast, premium siblings like the TVS iQube (starting ₹99,326) or Ather Rizta (₹1.12 lakh) edge over the threshold, delivering superior avionics and 150+ km ranges—but at a premium that alienates budget-conscious commuters. As one industry insider quipped, “These entry-level EVs feel like a teaser trailer: exciting at first glance, but the plot falls flat on real-world reliability.

“This scarcity stems from escalating battery costs, which constitute 40-50% of an EV’s price tag, and manufacturers’ reluctance to absorb margins without deeper subsidies. The FAME-III scheme, while extending incentives up to ₹10,000 per kWh, caps benefits at models above 80 km range—leaving many sub-₹1 lakh prototypes ineligible or underdeveloped.

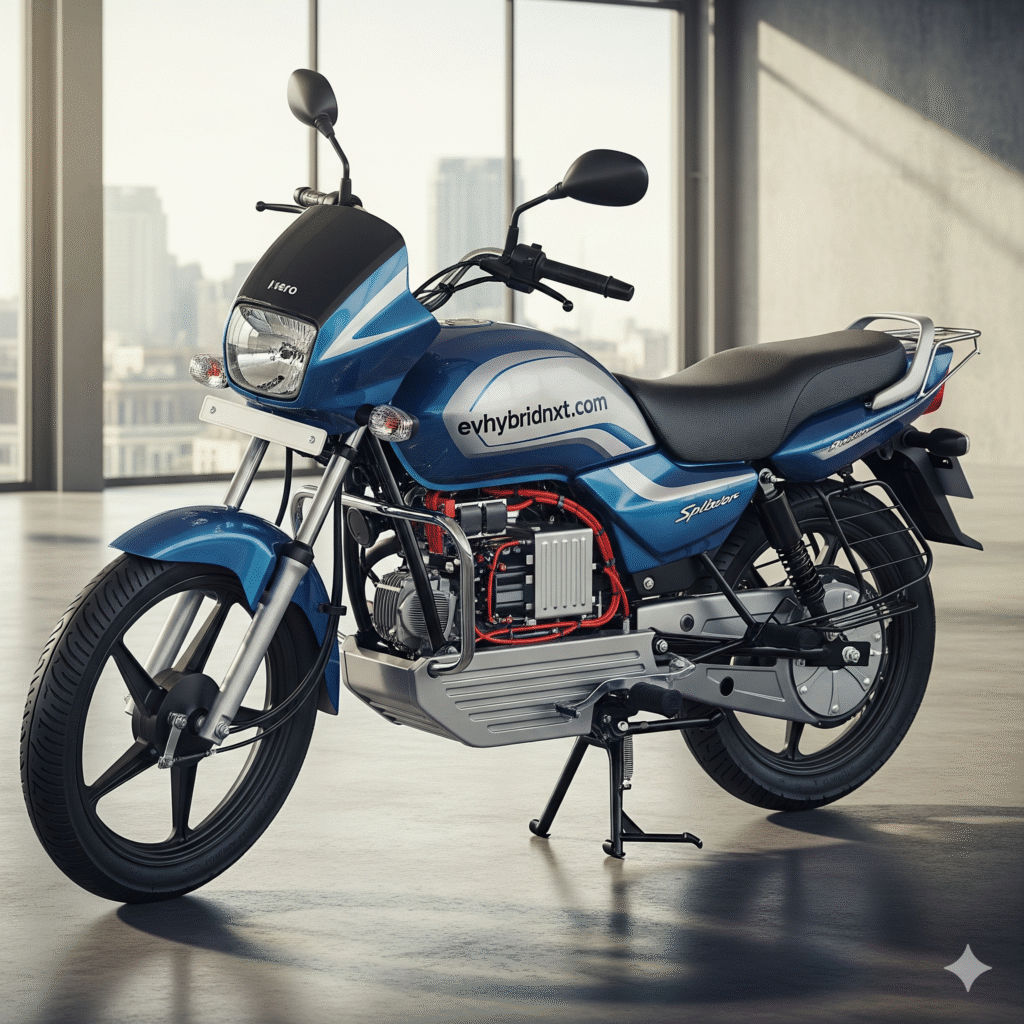

The fallout is stark in adoption metrics. Despite a 17% YoY sales spike in early 2025, EV two-wheelers captured just 6.1% of the overall 2W market in May, with electric scooters hitting 8.7% penetration by March. This lags far behind the potential: surveys indicate 70% of Indian two-wheeler buyers would switch to EVs if priced under ₹1 lakh with a 100 km daily range. Instead, the mass market clings to petrol stalwarts like the Hero Splendor (₹73,523) or Bajaj Pulsar 125 (₹80,004), which dominate with 20 million annual sales.

Urban millennials and rural gig workers—prime EV targets—are hit hardest. Higher upfront costs (20-30% more than ICE equivalents) exacerbate the urban-rural divide, where charging infrastructure remains a pipe dream outside metros. A NITI Aayog report pegs the EV opportunity at $200 billion, yet warns that without affordable entry points, two-wheelers could miss their 58-59% share of the EV pie by 2030. Experts at the India Future of Change conference echoed this, highlighting how voltage fluctuations and dust-laden roads demand rugged, low-cost designs that current sub-₹1 lakh models simply don’t deliver.

Government policies, while visionary, grapple with implementation hurdles. The 2025 EV policy emphasizes localized manufacturing and incentives, but battery recycling mandates and import duties on lithium-ion cells inflate costs for startups like Okinawa or Ampere. Key challenges include sparse charging networks (only 12,000 public stations nationwide) and resale value concerns, deterring fence-sitters.

To reignite growth, stakeholders urge a multi-pronged assault: enhanced PLI schemes targeting sub-₹1 lakh segments, partnerships with battery giants like Panasonic for cost cuts, and R&D tax breaks for high-altitude, dust-proof innovations tailored to India’s chaos. Players like Mahindra and TVS are pivoting, with whispers of 2026 launches blending series-hybrid tech for extended ranges without premium pricing. As Revolt Motors’ blog notes, “The 2025 policy pivot could unlock a floodgate if affordability leads the charge.”